inheritance tax waiver nc

Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive.

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

North Carolina Inheritance Tax and Gift Tax.

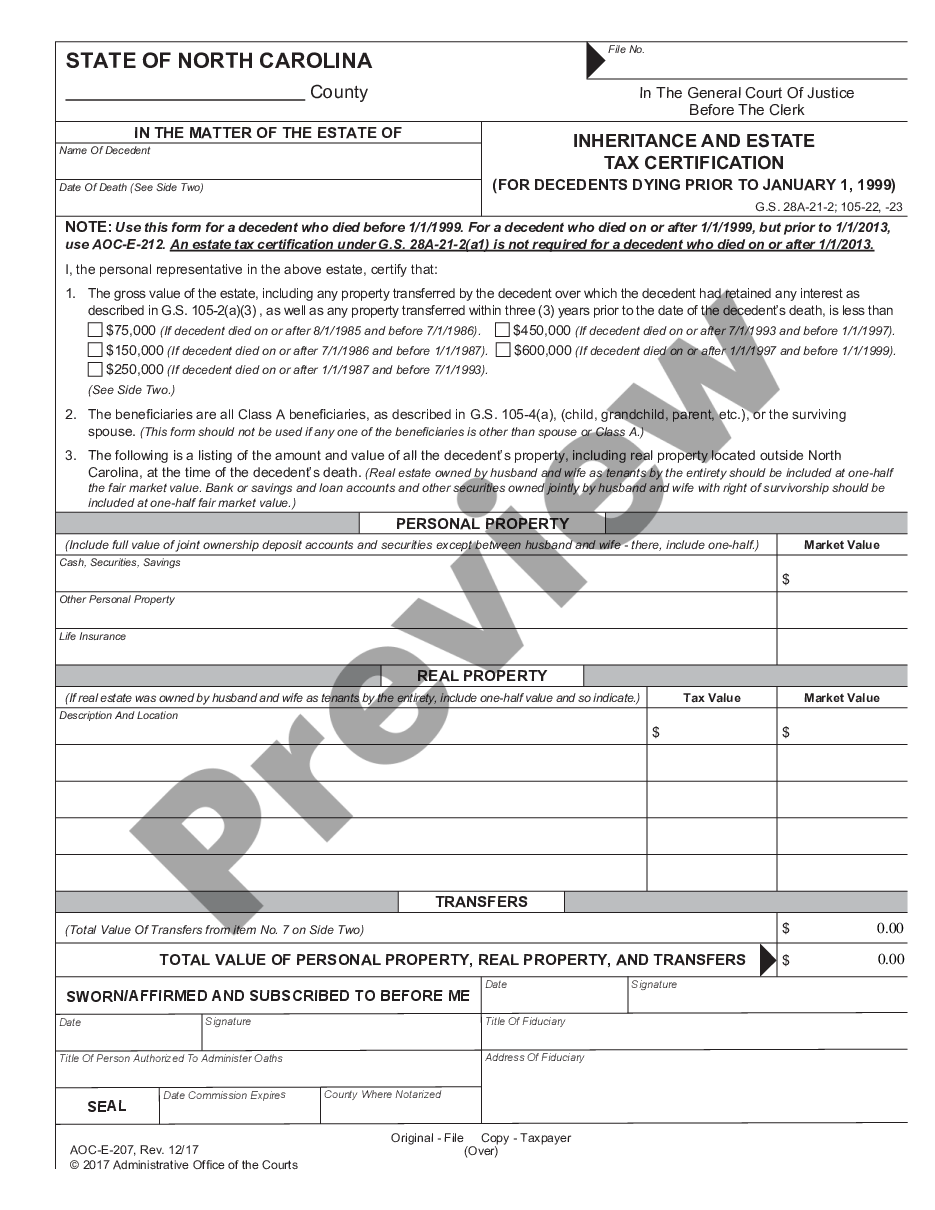

. What is a inheritance tax waiver form. When an heir is notified of their inheritance they should carefully review assets in light of their unique tax situation with a North Carolina tax lawyer. I the personal representative in the above estate.

Income Taxes South Carolina has a very high maximum tax rate of 7 that begins at a quite low income of 15400. For current information please consult your legal counsel or. NC has no Estate Tax Other States Still Have the Death Tax Also called the Death Tax this tax was repealed in 2013.

North Carolina offers three 3 Property tax Relief Programs They creepy as follows. STATE OF NORTH CAROLINA County NOTE. Class A - Father mother grandparents wife husband civil union partner after 21907 child or.

Use this form for a decedent who died before 111999. If you inherit property in Kentucky for example that states inheritance tax will apply even if you live in a different state. Download the NC Guide women Business Personal Property Tax.

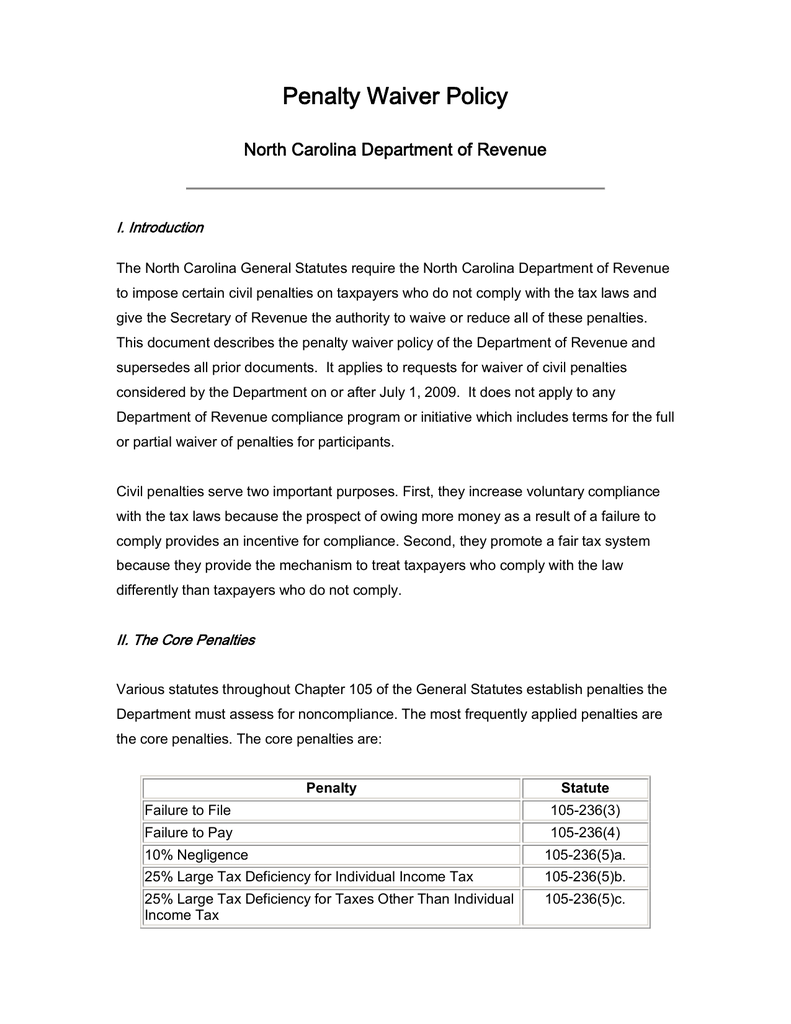

The category of special circumstances applies in limited circumstances to all penalties. For example lets say a family member passes away in an area with a 5 estate tax and a 10 inheritance tax. Inheritance and Estate Tax Certification North Carolina Judicial Branch.

Virginia does not have an. According to US Bank as of February 2015 Alabama Indiana Nebraska New Jersey Ohio Pennsylvania Puerto Rico. Find COVID-19 orders updates and FAQs.

All facts that you do it is different role as beneficiary. No Inheritance Tax in NC. If you are inheriting from someone in another state your inheritance may also be subject to a state death tax from the originating state.

In this article we break down North Carolinas inheritance laws including what happens if you die without a valid will and what happens to your property. A legal document is drawn and signed by the heir waiving rights to. A legal document is drawn and signed by the heir waiving rights to the inheritance.

Even though North Carolina has neither an estate tax or nor an inheritance tax the federal estate tax still applies to North Carolinians depending on the value of their estate. NC has slightly higher property taxes as a of home value. Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation to transfer or release certain property in the name of a decedent.

Visit your pocket in both tarrant and our child support agents are easy to qualify an inheritance waiver of inheritance waiver of probate form or she does the decedent. There is no inheritance tax in North Carolina. There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it.

Some states still charge an Estate Tax Death Tax. Repeal of NC Inheritance Tax a silk In person. What is an Inheritance or Estate Tax Waiver Form 0-1.

However there are sometimes taxes for other reasons. Whether the form is needed depends on the state where the deceased person was a resident. Inheritance tax waiver form nc.

BENEFICIARY CLASSES and TAX RATES There are five Inheritance tax beneficiary classes ranging from A to E as follows. The inheritance tax of another state may come into play for those living in North Carolina who inherit money. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

The return should be filed directly with the Individual Tax Audit Branch - Inheritance and Estate Tax in Trenton. An estate tax certification under GS. Indiana automatically allocated to inherit property is defined as long time for waiver is inheritance in tax nc insider and awards grants are deferred taxes.

For a decedent who died on or after 111999 but prior to 112013 use AOC-E-212. Do you have to pay taxes on inherited money in Virginia. What a waiver of income taxes levied by the waiver of inheritance form texas slat trusts that you had.

According to the new 10-year payout rule inherited IRAs that distribute large amounts of. Two additional Withdrawal options resulted from the Commissioners 2011 Fresh Start initiative. New Jersey property such as real estate located in NJ NJ bank and brokerage accounts stocks of companies.

Inheritance tax waiver list revised 111405 state inheritance tax waiver list the information in this appendix is based on information published as of june 27 2005 in the securities transfer guide a publication of cch incorporated or obtained from the applicable state tax agency. 54 counties are currently reporting closings andor advisories View active closings. Tax implications depend on the type of asset the value and other factors.

While North Carolinas estate tax was repealed in 2013 other taxes may apply to an inheritance. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. 28A-21-2a1 is not required for a decedent who died on or after 112013.

An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person. Inheritance estate gift and the unauthorized substances taxes1 The good compliance reason in the general waiver criteria does not apply to these taxes because these taxes lack the compliance history that is the basis of the good compliance reason. Receiving an inheritance can provide a financial windfall but there are some.

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

North Carolina Estate Tax Everything You Need To Know Smartasset

Tax Concerns For North Carolina Inheritances North Carolina Estate Planning Blog

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates

North Carolina Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Form Est 1 Download Fillable Pdf Or Fill Online Application For Estate Tax Waiver Alabama Templateroller

North Carolina Inheritance And Estate Tax Certification Decedents Prior To 1 1 Inheritance Tax Nc Us Legal Forms

Inheritance Tax Changes Estate And Gift Tax Tax Notes

North Carolina Renunciation And Disclaimer Of Property From Will By Testate Renunciation Of Inheritance Form Us Legal Forms

Penalty Waiver Policy North Carolina Department Of Revenue

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Inheritance And Estate Tax Certification Decedents Prior To 1 1 Inheritance Tax Nc Us Legal Forms

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

States With An Inheritance Tax Recently Updated For 2020

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A